24+ gift money for mortgage

Compare Apply Directly Online. The lifetime limit in 2022 is 1206 million.

Mortgage Loan Mbc

Ad Check Todays Mortgage Rates at Top-Rated Lenders.

. A conventional loan is a mortgage that isnt insured or guaranteed with any government entity. Who can receive who can give differences in rules across loan programs gift letters and tax considerations. Web Who can give you gift money.

Web However if someone gifts you money for your FHA down payment or closing costs you must abide by the rules and regulations of an FHA loan. Web Gift money is money that has been given to a borrower for the purpose of buying a home. Usually borrowers use the money to cover their down payment or.

Web During 2022 a family member can give you up to 16000 without any tax consequences. Generally any family member can gift money for a down payment. Web The stipulations for needing a 5 investment from the borrower when utilizing gift money for a conventional mortgage are.

Web Who can gift money for a mortgage down payment. Web Using your gift money with a conventional loan. If youre in the position to add personal savings to your gifted deposit it could be a wise thing to do.

The IRS imposes a gift tax on certain monetary gifts and this tax is paid by the person donating the money. Amounts exceeding the limits. Web Tax Implications for the Giver of a Down Payment Gift.

Web For single-family units. If youre putting down 20 or less on your home purchase the entire down payment can be from gift money. So if you think FHA.

In fact the bigger the deposit you put down the. Web For conventional loans backed by Fannie Mae or Freddie Mac. Web Yes you can.

If the loan amount exceeds the national conforming limit of. That includes parents grandparents. Lenders are OK with borrowers using down payment gifts as long as the donor shares a close relationship that and this is the important part.

Ad The Leading Online Publisher of National and State-specific Gift Legal Documents. This gift will go against their lifetime. Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More.

Web By a tax rule known as gift splitting married couples can gift up to 32000 in 2022 or 34000 in 2023 to another person without liability as well. Web The annual exclusion per individual recipient is 16000 for 2022 so if your gift exceeds that the donor will have to file a gift tax return. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years.

Web If you know that youll be getting any financial gift to help with your down payment be prepared to document it for your mortgage company. The gift can finance 100 of your down payment assuming you put at least 20. The gift can finance 100 of your down payment.

Web Learn the basics of mortgage gift funds.

Gift Money Can Meet Your Down Payment Needs Nerdwallet

Free 20 Sample Gift Letter Templates In Pdf Ms Word Pages Google Docs

Launch Grow Rich Start Up Your Small Business Money Maker Kirk Randy W Mabalay Sah Amazon De Books

Free 5 Sample Mortgage Commitment Letter Templates In Pdf Ms Word

What Is A Down Payment Gift What You Need To Know

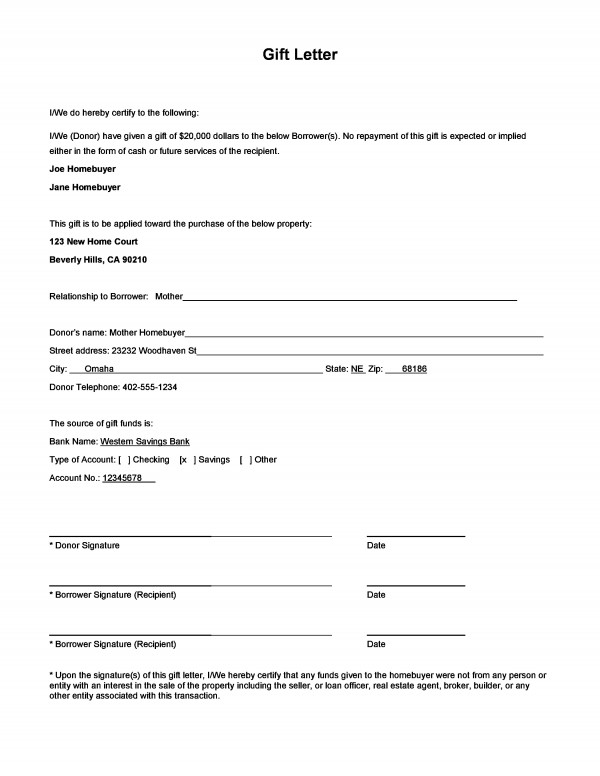

What Is A Gift Letter For A Mortgage

Gift Money For Down Payment Free Gift Letter Template

Delegated Underwriting Training Ppt Download

Cmp 15 11 By Key Media Issuu

What To Know About Mortgage Gift Letters Trusted Choice

Amortization Fascination And Infuriation Life On Virginia Street

Don T Count On Gift Money For A Down Payment Without Knowing The Rules First Huffpost Life

Innovation And Enterprise Blog

The Millionaire Mortgage Broker Amazon Co Uk Seppinni Darrin 9780071481564 Books

Mortgage Down Payment Gift Rules Who What Why A Letter

How To Complete A Gift Letter For A Mortgage Lendingtree

Top Programming Institutes In Dhankawadi Pune Best Coding Classes Justdial